Understanding and Reducing Your Expenses

Learn effective strategies to understand and reduce your expenses, helping you achieve financial stability and peace of mind.

Understanding Your Expenses

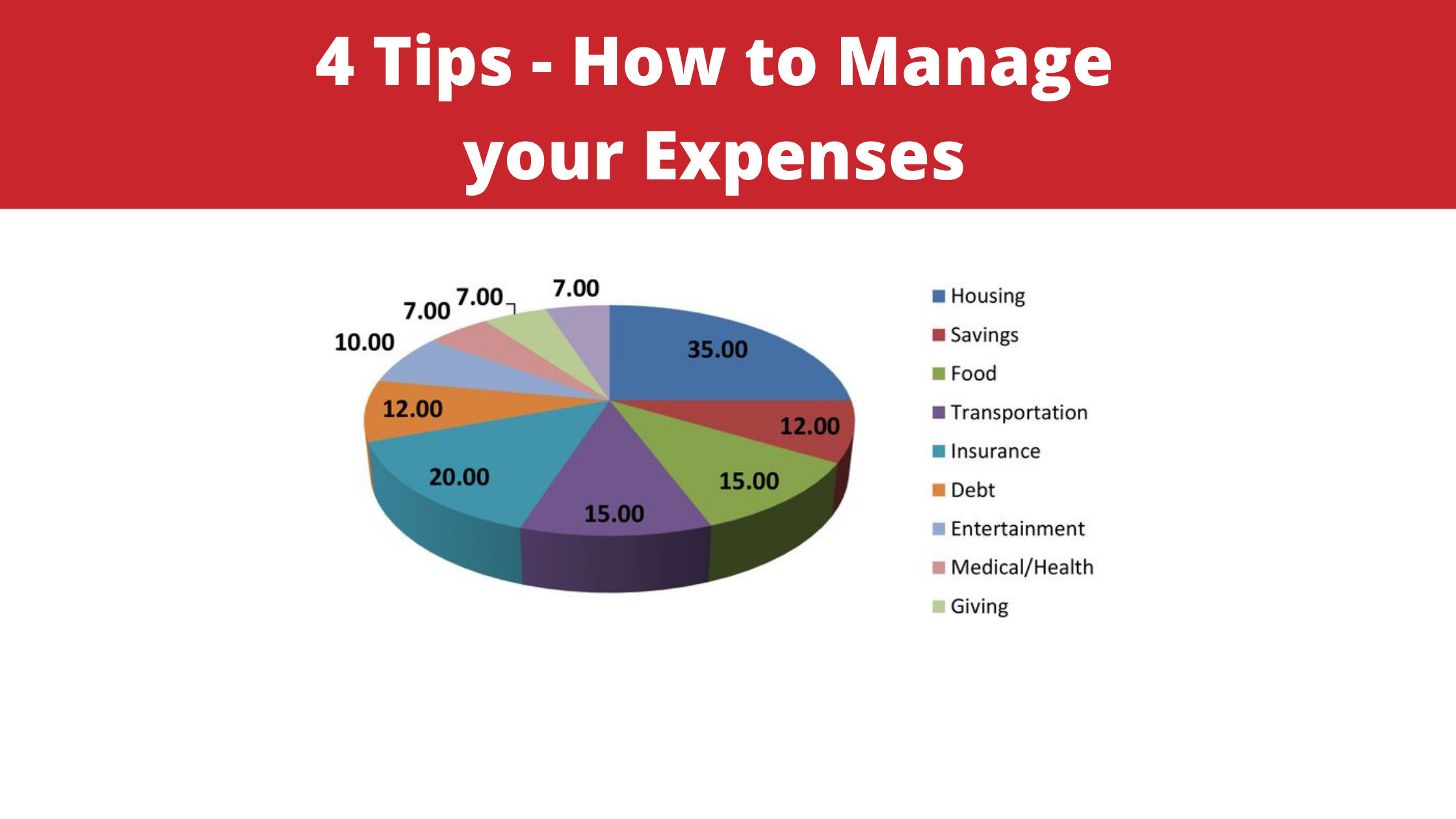

Before you can effectively reduce your expenses, it's crucial to understand where your money is going. Start by categorizing your spending into essential and non-essential expenses. Essential expenses include housing, utilities, groceries, and transportation. Non-essential expenses might include dining out, entertainment, and luxury items. By meticulously tracking your spending for a month, you'll gain a clear picture of your financial habits. Use tools like budgeting apps or a simple spreadsheet to log every expense. This practice not only highlights areas where you might be overspending but also helps in setting realistic financial goals.

Creating a Budget

Once you have a clear understanding of your expenses, the next step is to create a budget. A budget is a financial plan that allocates your income towards expenses, savings, and debt repayment. Start by listing your monthly income and then subtract your essential expenses. The remaining amount can be divided between savings and discretionary spending. Sticking to a budget requires discipline, but the benefits are immense. It helps you avoid unnecessary debt, prepares you for unexpected expenses, and ensures you are saving for future goals. Regularly review and adjust your budget to reflect any changes in your income or expenses.

Reducing Non-Essential Spending

Reducing non-essential spending is one of the quickest ways to lower your expenses. Start by identifying areas where you can cut back without significantly impacting your lifestyle. For example, instead of dining out multiple times a week, try cooking at home. Cancel subscriptions and memberships you rarely use, and look for free or low-cost entertainment options. Another effective strategy is to practice mindful spending. Before making a purchase, ask yourself if it is something you truly need or if it can be postponed. Small changes in your daily habits can lead to significant savings over time.

Managing Debt Wisely

Debt can be a major drain on your finances if not managed wisely. High-interest debts, like credit card balances, can quickly spiral out of control. Focus on paying off high-interest debt first while making minimum payments on lower-interest debts. Consider consolidating your debts to secure a lower interest rate or more manageable payment terms. Additionally, avoid accumulating new debt by sticking to your budget and using credit cards responsibly. By reducing your debt, you free up more of your income for savings and other financial goals, reducing financial stress and improving your overall financial health.

Building an Emergency Fund

An emergency fund is a crucial component of a healthy financial plan. It provides a safety net for unexpected expenses, such as medical emergencies, car repairs, or job loss. Aim to save at least three to six months' worth of living expenses in a separate, easily accessible account. Building an emergency fund takes time and discipline, but the peace of mind it offers is invaluable. Start by setting aside a small amount from each paycheck and gradually increase your contributions as you adjust your spending habits. Having an emergency fund not only protects you from financial shocks but also prevents you from going into debt when unforeseen expenses arise.