Understanding Credit Scores: What You Need to Know

Learn the essentials of credit scores, how they impact your financial health, and tips to improve your score effectively.

What is a Credit Score?

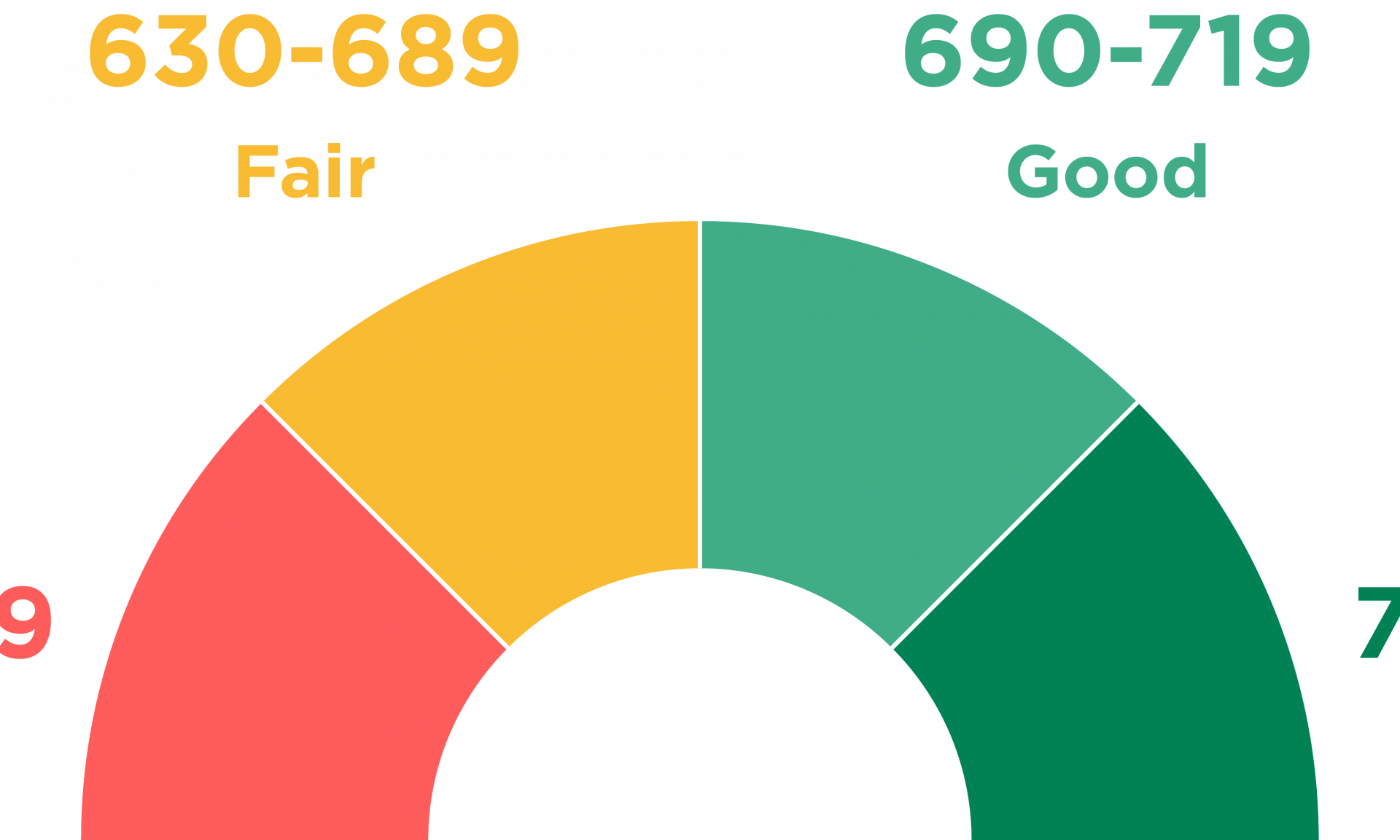

A credit score is a numerical representation of an individual's creditworthiness. Financial institutions use this score to assess the risk of lending money or extending credit. Scores typically range from 300 to 850, with higher scores indicating better creditworthiness. A credit score is calculated based on various factors, including payment history, amounts owed, length of credit history, types of credit used, and new credit inquiries. Understanding your credit score is crucial because it can impact your ability to secure loans, credit cards, and even influence rental agreements and job opportunities. Regularly monitoring your credit score can help you maintain good financial health and identify areas for improvement.

Importance of Payment History

Your payment history is the most significant factor influencing your credit score. Lenders want to see that you can manage your debts responsibly. Late payments, defaults, and bankruptcies can severely damage your score. Conversely, consistently making payments on time can improve your score. Setting up automatic payments or reminders can help ensure you never miss a due date. Even one missed payment can have a long-lasting negative impact, so it's essential to prioritize timely payments. Over time, a solid payment history will build a strong foundation for a healthy credit score, reflecting your reliability to potential lenders.

Impact of Credit Utilization

Credit utilization refers to the percentage of your available credit that you are using at any given time. It is a critical component of your credit score, second only to payment history. A lower credit utilization ratio indicates that you are not overly reliant on credit, which is favorable in the eyes of lenders. Experts suggest keeping your credit utilization below 30% to maintain a healthy score. For example, if you have a total credit limit of $10,000, try to keep your outstanding balances below $3,000. Regularly paying down your balances and avoiding maxing out your credit cards can help manage your credit utilization effectively.

Length of Credit History

The length of your credit history also plays a significant role in determining your credit score. Lenders prefer borrowers with a long track record of responsible credit use. This factor considers the age of your oldest account, the age of your newest account, and the average age of all your accounts. While you can't speed up time, you can manage this aspect by keeping older accounts open, even if you no longer use them frequently. Closing old accounts can shorten your credit history and potentially lower your score. Patience and responsible management of both new and old credit accounts can positively influence this aspect of your credit score.

Types of Credit in Use

Diversity in the types of credit you use can also affect your credit score. This factor looks at your mix of credit accounts, including credit cards, mortgages, auto loans, and other installment loans. Having a variety of credit types shows lenders that you can handle different kinds of credit responsibly. However, it's not necessary to have every type of credit account. Focus on managing the credit you do have effectively. For example, if you have a credit card and a car loan, making timely payments on both can demonstrate your ability to manage different types of debt.

The Role of New Credit

Opening several new credit accounts in a short period can be risky and may negatively impact your credit score. Each time you apply for new credit, a hard inquiry is made on your credit report, which can temporarily lower your score. Additionally, new accounts lower the average age of your credit history, which can also hurt your score. It's important to be strategic about applying for new credit. Only seek new credit when necessary and be mindful of the potential impact on your credit score. Over time, responsible management of new accounts can help mitigate any initial negative effects.

Monitoring Your Credit Report

Regularly monitoring your credit report is essential for maintaining a healthy credit score. Your credit report contains detailed information about your credit history and is used to calculate your credit score. Reviewing your report can help you identify any errors or fraudulent activities that could be affecting your score. You are entitled to a free credit report from each of the major credit bureaus annually. Take advantage of this to check your report for accuracy. If you find any discrepancies, report them immediately to have them corrected. Staying informed about your credit report can help you maintain control over your financial health.

Improving Your Credit Score

Improving your credit score requires time, effort, and a strategic approach. Start by making timely payments and reducing your credit utilization. Diversify your credit types if possible, but avoid opening too many new accounts at once. Regularly monitor your credit report for accuracy and address any issues promptly. Building a strong credit history takes time, so be patient and consistent in your efforts. Responsible financial habits, such as budgeting and saving, can also support your goal of improving your credit score. Over time, these practices will help you achieve and maintain a healthy credit score, opening doors to better financial opportunities.